Why is it Important for Players and Family members to be covered?

Pre-existing conditions are not covered under the Manulife Plan A that we recommend. It is important to understand what that is so you can reach out to us if this is a concern for you. A pre-existing condition is typically defined as any sickness, injury or medical condition for which you consulted a physician, had symptoms, were hospitalized or prescribed medications within a 6-month period before the effective date of the policy.

During your coverage period, you can contact the Assistance Centre for prior approval to return home under the Trip Break benefit, your Visitors to Canada coverage will be suspended but not terminated and when you return to Canada, your policy coverage will resume. There will be no refund of premium for any of the days during your return home and your end date of coverage must include dates you are back home.

A waiting period will apply, except in the case of injury, if you purchase this insurance after your arrival in Canada or after the expiry date of an existing Visitors to Canada policy issued by us. Waiting period means the 48-hour period following and including your effective date of insurance if you purchase your policy after the expiry date of an existing Manulife Visitor to Canada policy; or after you arrive in Canada.

Here are the Steps to Book your Travel Insurance:

1. Begin the process

To get started, under Visitors to Canada click Get a Quote

2. Tell us about your Trip

For the question “Do you need insurance for super visa” click NO

Complete:

Date Arriving in Canada & Coverage Start Date = Date Arriving in Canada

Enter End Date: March 31*

*Even if returning home for the holidays

Amount of Emergency Medical Coverage: $100,000

While in Canada, where will you primarily be staying? Answer: Ontario

Type of Coverage: Single

Enter: Date of Birth

Click Show Plans

3. Choosing your Plan

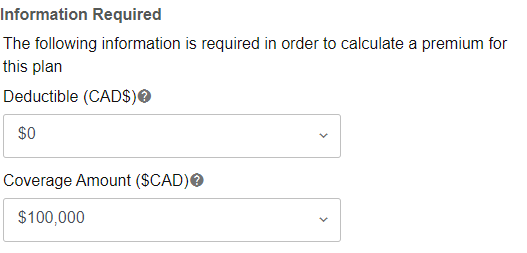

CHANGE Deductible to $0

Coverage amount must be set to $100,000

Trip Interruption: Select NO

Read Eligibility Information & Pre-existing Condition Exclusion (see above for explanations of these terms)

Click Apply

4. Personal Information

Enter the Email address of the person paying for the policy.

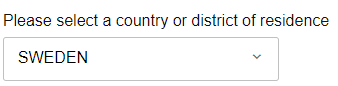

Enter Country or District of Residence which is your Home Country

Enter Contact Information while in Canada including Primary Phone Number (could be coach or billet phone number)

Click Continue

5. Purchase the Plan

Review Summary for Errors.

Enter Credit Card Details (no Visa Debit allowed)

Click on the Box Accept Terms and Conditions

Click Purchase

Final Step

Click on Policy Number for your confirmation certificate.

A copy of this confirmation will be emailed to you.

To open, you will be prompted for your arrival date and Canadian Phone Number.

Enter this information to view AND/OR print your confirmation.

NOTE: we advise you to keep a printed copy of your insurance card on your person at all times when in Canada, and remember to contact Manulife (info on the card) before seeking medical attention.

Information for Parents and/or Caregivers accompanying Players

Important Information for Insurance Claims

To initial your claim, use the submit claim documents link below.

- Call Manulife 1-877-878-0142

- Submit Claim Documents

Important Links for your Travel Insurance Needs:

To Download a PDF of the instructions that you can print, click here

For family members who wish to purchase a Manulife Plan, click here

To download a copy of the insurance policy wording click here

If you are not sure what coverage you need, please email us at travel@scinsurance.ca and we will get back to you in 1-2 business days.