The Hidden Benefits of Corporate Owned Life Insurance:

The Corporate Estate Bond

The Corporate Estate Bond

Are you an incorporated business owner with retained earnings trapped inside your corporation?

With the recent announcement about increased taxes on Capital Gains, you are likely more concerned than ever about how to extract these funds without surrendering even more to the CRA. The frustration of paying taxes both corporately and personally is top of mind for many of our clients.

With the recent announcement about increased taxes on Capital Gains, you are likely more concerned than ever about how to extract these funds without surrendering even more to the CRA. The frustration of paying taxes both corporately and personally is top of mind for many of our clients.

The Challenge: High Tax Rates for Successful Business Owners

If your business is profitable, you are no stranger to the substantial tax burden you face each year. Gains on excess funds left in your corporation are taxed at the very highest passive income tax rates, and then essentially waiting to be taxed again when you look to get the funds out of your Corp, or even into the hands of your family or estate.

The Solution: Corporate-Owned Life Insurance

By utilizing the preferential tax treatment afforded to Life Insurance, this is one of the rare opportunities to use those Corporate funds in order to generate a significant personal tax-free benefit for yourself and your loved ones.

HOW DOES IT WORK?

Excess corporate funds are invested in a permanent life insurance policy where they accumulate tax-free to create a significant investment account within the policy. Think of it as a TFSA for your business! The funds grow at a healthy yet conservative pace, in a hands-off account without the need for stressful investment decisions or attempts to time the market. If there is a need for funds during your lifetime, this account and policy can be used as collateral for a simple, tax-efficient loan or line of credit.

The key benefit of this strategy lies in the tax-advantaged treatment of Corporate Owned Life Insurance. In the event of death, payouts are made tax-free the Corporation, but the Corporation receives a corresponding Capital Dividend Account (CDA) tax credit, to allow shareholders to get funds out of the Corporation tax-efficiently.

This effectively allows you to use Corporate Funds, that you don’t want to pay tax to get out of your Corporation, in order to generate a tax-free benefit for your family and estate.

The key benefit of this strategy lies in the tax-advantaged treatment of Corporate Owned Life Insurance. In the event of death, payouts are made tax-free the Corporation, but the Corporation receives a corresponding Capital Dividend Account (CDA) tax credit, to allow shareholders to get funds out of the Corporation tax-efficiently.

This effectively allows you to use Corporate Funds, that you don’t want to pay tax to get out of your Corporation, in order to generate a tax-free benefit for your family and estate.

KEY BENEFITS:

- Tax-Efficiency: Use “trapped” corporate funds to generate a personal tax-efficient benefit

- Estate Planning: Coverage can be used to pay any estate and other taxes, ensuring a substantial legacy.

- Liquidity and Flexibility: Access the accumulated cash value for personal or business needs without incurring immediate tax liabilities.

IDEAL FOR:

- Business owners and Professionals looking to minimize the impact of our current tax system.

- Those interested in tax-efficient estate planning and wealth accumulation.

- Anyone with a Corporation that you intend to keep in place for the long term.

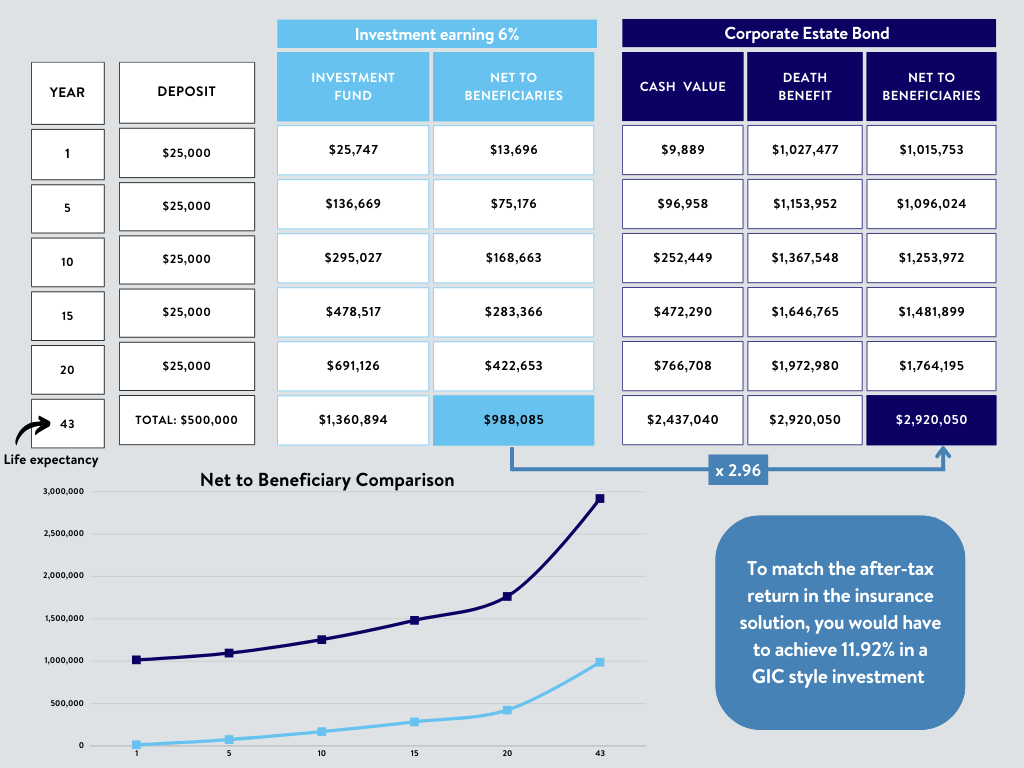

Case Study: Taxable Investment vs The Corporate Estate Bond

Consider Business Owners, Mark & Jennifer, age 50 – they have excess funds in their corporation, and have a couple of options to put these excess funds to work – they can invest in a taxable instrument, or consider the Corporate Estate Bond.

Below is an example comparing the values of both options, depositing the same $25,000 per year for 20 years ($500,000 total Deposits).

Option 1 – Invest in a taxable investment, example: GIC earning 6%

Option 2 – Deposit the same amount into an Insurance Solution

Below is an example comparing the values of both options, depositing the same $25,000 per year for 20 years ($500,000 total Deposits).

Option 1 – Invest in a taxable investment, example: GIC earning 6%

Option 2 – Deposit the same amount into an Insurance Solution

Conclusion: Take Control of Your Financial Future

In light of the new tax rules, and the spotlight on business owners today, we have identified The Corporate Estate Bond as a powerful tool to help you maximize the benefits of your corporate funds.

Don’t let your hard-earned corporate surplus remain underutilized. Take action now to ensure your financial future and leave a lasting legacy for those you care about most. Contact us today to schedule a consultation and explore how Corporate-Owned Life Insurance can work for you.

Don’t let your hard-earned corporate surplus remain underutilized. Take action now to ensure your financial future and leave a lasting legacy for those you care about most. Contact us today to schedule a consultation and explore how Corporate-Owned Life Insurance can work for you.

Contact us to talk to an Advisor

Recommended Articles

Byond – An Innovative Approach to your Health Care

We are extremely excited to announce a new health resource available exclusively to SC Insurance clients. Byond is...

Read MoreLife Insurance – Understanding your Options

Life insurance can be a complicated and often misunderstood product when not explained properly. Below is a brief...

Read MoreYour Estate Plan: Creating a Legacy, While Preserving Your Wealth

Many of our clients are reaching a new phase in their lives where they are thinking about their...

Read More